French IP BOX : how to benefit from this regime?

French IP BOX – Abstract

The French IP BOX or the taxation of software royalties at a reduced rate (10%), and more broadly of industrial property products, offers substantial corporate tax savings. However, their implementation is complex and subject to certain conditions. In this first part, we will look at the economics and the substantive and formal conditions of this scheme, which is little-known to companies, especially start-ups and subsidiaries of foreign groups.

French IP BOX: How does it work in a few words?

The French IP BOX is an optional scheme that allows income from the sale or sublicensing of patents and fixed assets to be taxed at a rate of 10%. It establishes a direct link between the tax advantage and the amount of R&D expenditure incurred to create these fixed assets.

Eligibility requirements

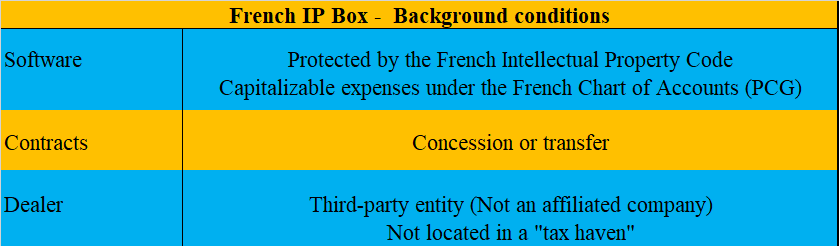

About software…

The software (or patents) must be

- Be protected by copyright as defined in article L 112-2 of the French Intellectual Property Code, and therefore be original,

- Present the nature of fixed assets.

On this last point, the fact that research and development costs have been expensed is not an obstacle to benefiting from the system. In fact, the Chart of Accounts allows them to be capitalized.

The company that benefits from the French IP Box must carry out a substantial activity linked to the work’s use, valorization or development, patent or right concerned. This activity is assessed on the basis of criteria such as the number of qualified employees dedicated to it, or R&D expenditure.

…And contracts

They must

- Taking the form of contracts

- licensing, i.e. allowing a third-party licensor to exploit the software for a fee,

- or sale, i.e. the disposal of an asset, depriving the seller of a future source of income.

- Have not been assigned to an entity

- Not at arm’s length from the licensor,

- Located in a territory that has not signed an administrative assistance agreement with France.

IP BOX: Background conditions – to sum up

French IP Box