Incentives in France: what you need to know

Incentives in France : background

France has been always a land of breakthroughts : the country invented, among others, photography and the combustion engine, pioneered the automotive and the aircraft industries. It also discovered radioactivity and certain major deseases.

Given the aforementioned facts, France started to support the high tec sector 30 years ago. The country beefed up the policy over the past years, by supplying a wide range of grants and tax credits.

Conditions to get these incentives

In general

As mentionned before, the company needs most of the time to develop innovative technologies (Information and communication technologies (ICT), biotechnologies, renewable technologies, innovative materials, nanotechnologies, etc.). However, if the sector in which they operate does not target innovation, some of them can be acquired, provided the company has ambitous objectives.

Depending on the programm, the incentives are restricted to Small or Medium Enterprise under the European definition (less than 250 employees, annual turnover below 50M€ or a total balance sheet below 43M€. No requirements exist regarding the shareholding.

Finally, the seniority of the company matters most of the time little, even not at all. For some of them, it is not required that the company be incorporated to apply for them. However, it needs to exist to cash the incentives.

..and applied to branches or subsidiaries of foreign small businesses

A newly subsidiary or branch founded by a foreign group can benefit from all these incentives as any French company if the consolidated turn-over and the balance sheet of the mother company it belongs to and all its subsidiaries remain below these thresholds.

Hence, foreign firms can hire people, especially engineers, developpers etc.. working in the innovative sector at a very interesting value for money.

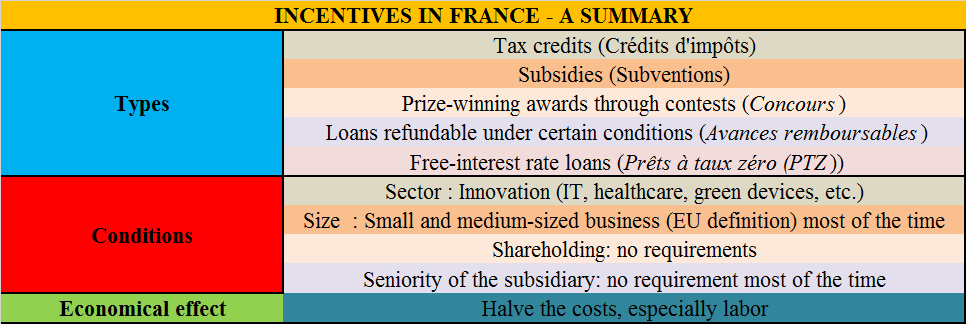

Taxonomy of incentives in France and economical effect – in brief

Incentives in France can be classified in 5 categories; tax credits, prize-winning awards, sudsidies and reimbursable supports, free-interest rate loans.

Most of time, there are no restrictions to add these incentives to each other. As a result, the support from French government can easily support over 50% of the outlays. In other words, they can significantly decrease the cost of labor.

Incentives in France – A Summary

For tax credits, for further information, click here

For prize-winning awards through contests, go to The Worldwide Innovation Challenge (Concours Mondial de l’Innovation in French) that can award up to a 20 M€ grant,

As for Subsidies, click Reimbursable financial support or innovation subsidies,

And here for loans for innovation.

Need more information?