Innovation : subsidies in France dedicated to innovation

Subsidies in France: General Overview

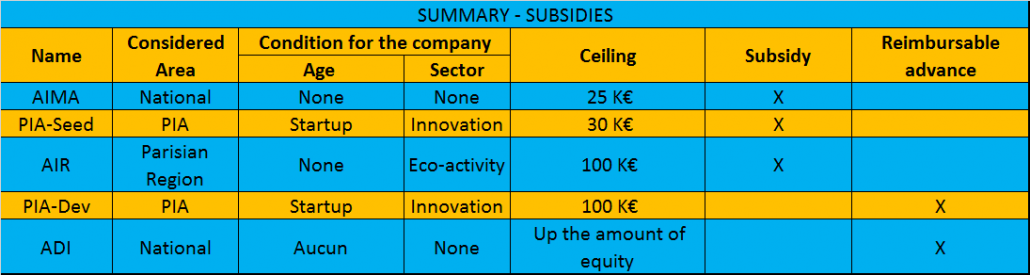

In the Parisian region (IDF: Ile de France in French), International groups wishing to start a business in France, in particular an innovative one, can profit from 4 financial support programs, two of which are national. There are regional financial support programs in other regions comparable to those existing in the Parisian region.

Which criteria should be met to apply to these programs?

Depending on the program, the parent company (together with all its existing subsidiaries) shall be considered by the European legislation as either a medium-sized business (Turnover and balance sheet< 43 Million €, Staff members <250), or a small business (turn-over and balance-sheet <10 Million €, staff members < 50).

Most of the time, the seniority of the newly founded subsidiary is not always required. The only exception is the PIA program which is dedicated to start-up companies.

Finally, the subsidiary has to operate preferably in a forward-looking sector. However, for some grants, it is not a prerequisite provided the subsidiary has ambitious projects in France.

How much can these subsidies in France finance innovation?

They can fund up to 70% of research programs [internal or exterior] intangible expenses, with a ceiling from 25 to 80k€ when granted in the form of subsidies and sometimes more when granted in the form of reimbursable advances. The body that finances all these subsidies is BPI.

If these research programs are collaborative (i.e. they are managed by several companies), financial support can be even more substantial (several million Euros).

As opposed to the subsidy [which is in principle definitively granted to the company] the financial support is reimbursable if the financed program is a commercial success. In such a case, the reimbursement is always interest-free.

These grants can be accumulated with prize-winning awards such as the Worlwide Innovation Challenge (WIC), loans for innovation, and fiscal support for innovation, whether the company is eligible for the Research and Development Tax Credit (C.I.R: Crédit d’Impôt Recherche in French) or the Young Innovating Company status (JEI: Jeune Entreprise Innovante in French).

It can be summarized as follows:

Subsidies in France

Need more information?