Tax credits in France: what you need to know

Tax credits in France – General objective

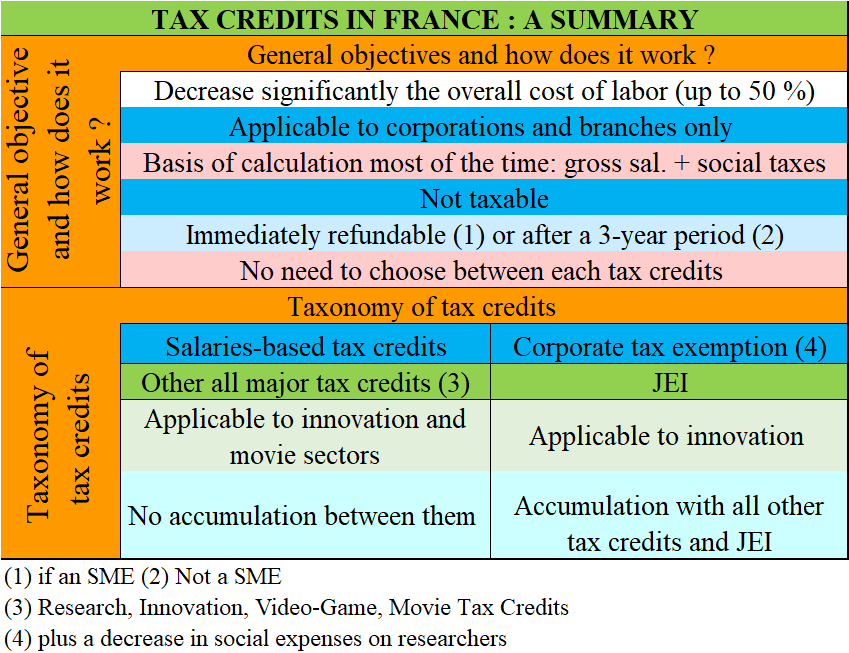

Tax credits in France can be likened to subsidies granted by the French Government. They are aimed at decreasing most of the time the overall cost of labor significantly when they can be combined with each other (up to 50%).

Tax credits in France – How does it work in brief?

Applicability, calculation and repayment..

First, applying for them assumes the entity pays corporate tax in France. Practically, branches and companies can claim tax credits. Liaison offices cannot claim them as they do not pay income tax in France.

Second, and as a result of the first paragraph, they often are calculated partially or even totally on gross salaries.

Third, they are never subject to corporate tax. Indeed, they are always deducted from the taxable profit. This feature makes them totally different from all other grants and subsidies. Prize-winning awards, subsidies and loans (whey they are not refundable any longer for certain conditions) are always included in the basis of the calculation of the corporate tax.

Finally, they are deducted from the tax bill any company has to pay each year. The excess of tax credits over the tax bill is either repaid immediately or maximum after 3 years, if the company has not been in a position to apply it to tax bills after this 3-year period. The terms of refund hinge either (i) on its size (an SME or not) and/or the type of tax credit.

Possible combination of tax credits?

The tax credits that are worthwhile to apply for can be added to each other with no restrictions. In other words, a company does not have to choose between certain tax credits.

Taxonomy of tax credits in France.

Wage tax credits…

All major tax credits (Research, Innovation, video games tax credits) subsidy beforehand wages.

As a result, the same € of gross salary spent to get to a given tax credit cannot finance another one. For instance, the same € of gross salary spent to get to the research tax credit cannot finance the video-games tax credit (and vice-versa).

…And the Young Innovative Enterprise (JEI) Status

The Young Innovative Enterprise Status (JEI) has a particular status. Indeed, it combines a corporate tax exemption over 24 months and a decrease in 2/3 of the social expenses on researchers’ salaries. It can be applied by SMEs whose seniority is lower than 8 years.

The JEI status is always accumulated all other tax credits, especially with the research tax credit. The corporate tax exemption (not the social tax advantage) is capped at € 200,000 .

Tax credits in France – A summary

Tax incentives France

Tax incentives in France

For further information, see below about the

the movie tax credit